Retirement Planning for Women

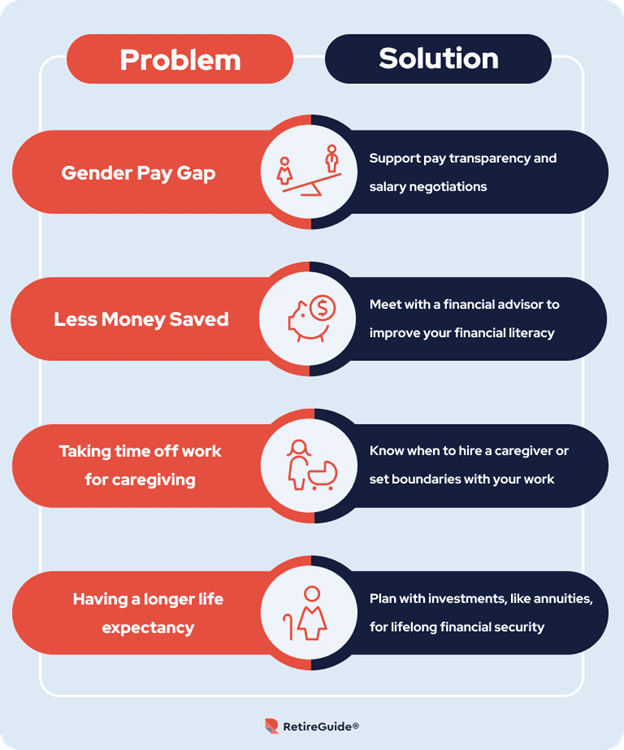

There are four main financial challenges women face when nearing retirement: the gender pay gap, having less money in their savings, taking time off work for caregiving duties and having a longer life expectancy. Learn about investment strategies, financial literacy and retirement lifestyle tips to start retirement planning today.

Never Miss Important News or Updates

Explore these tips to help guide your plans.

- Written by

Lindsey Crossmier

- Edited By

Lamia Chowdhury

- Published: October 4, 2023

- Updated: October 5, 2023

- 12 min read time

- This page features 8 Cited Research Articles

Key Takeaways

- Set annual budgets and revisit them frequently to ensure your change in needs align with your new goals.

- Consider your ideal retirement lifestyle, like your travel goals, to help you determine your savings goals.

- Investing isn’t always high-risk vehicles. There are safe, low risk investment and account options to consider.

- Without an estate plan, any decisions regarding your wealth, property and health are not in your control.

The Challenges Women Face Leading Up to Retirement

Women’s overall retirement income is 30% lower than men, according to a recent TIAA study. This, paired with a longer life expectancy, can put women at a risk of outliving their savings.

“One of the biggest challenges is not knowing how long women need to plan for,” Sybil Solomon, President of LifeWise Strategies, told RetireGuide. The average life expectancy is 79 years for women and 72 years for men, according to the Population Reference Bureau.

This guide will analyze the challenges women face and offer solutions to empower individuals to create a strong retirement plan.

Current State of Women Planning for Retirement

Over 50% of adult women don’t consider themselves financially secure, according to a 2023 article from the National Council on Aging. Financial insecurity can make retirement planning a very difficult, if not seemingly impossible, task.

However, if you address your fears, have an open mind and consider your unique risks — you’re likely to ease many of your retirement planning stresses.

3 Minute Quiz: Can You Retire Comfortably?

Take our free quiz & match with a financial advisor in 3 easy steps.

Tailored to your goals. Near you or online.

Attitudes Around Retirement Planning

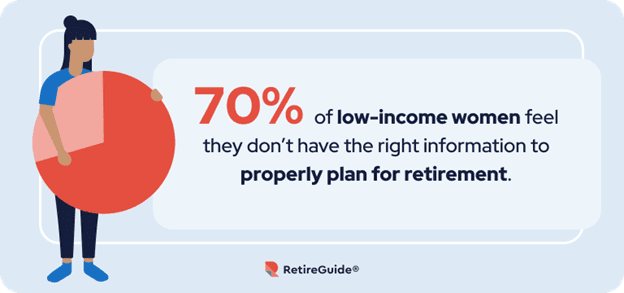

Retirement planning is an understandably daunting task. The future is unknown and estimated costs are constantly rising for insurance, housing and health care.

This and a lack of financial literacy can make retirement planning seem overwhelming for some. Nearly 70% of low-income women feel they don’t have the right information to properly plan for retirement, according to the National Council on Aging.

Source: National Council on Aging

Improving your financial literacy can help make retirement planning easier and remove mental roadblocks you may unknowingly have in place.

In several cases, Solomon found that women underestimated how much money they accumulated to retire. You could find retirement planning easy if you take the time to sit down with a financial professional.

“Sometimes, women have no idea how much money they actually have. And often, the reality is very different from their perspective. I’ve had a couple of women who really wanted to retire. But they kept saying that they couldn’t retire.”

“It took months to get them to sit down with somebody and look at their investments. In both cases, they could retire. But their perspective was that they couldn’t,” Solomon told RetireGuide.

Meet with a financial advisor to improve or build upon your financial literacy. Doing so can change fear associated with retirement planning into empowerment.

Approach To Investing

While most women feel confident managing day-to-day finances, they don’t always feel the same when it comes to long-term investing. According to a Fidelity study, only 19% of women feel confident selecting investments that align with their goals.

Luckily, women are becoming less hesitant to invest. According to the same study, one in five women reported making a first-time investment in new asset classes within the past year.

Start your investment journey by meeting with a financial advisor to break down your long-term goals for retirement. Seven in 10 women wish they had started investing their extra savings sooner.

Unique Risks

Many women face unique risks that create additional barriers when retirement planning. Some of which aren’t within our control, like the gender and racial wage gap. It’s substantially harder to save for retirement when everyone isn’t paid equally.

As of 2023, women who work full time are paid an average of 83.7% as much as men, which amounts to a difference of $10,000 per year, according to the U.S. Department of Labor. Other minority women made even less.

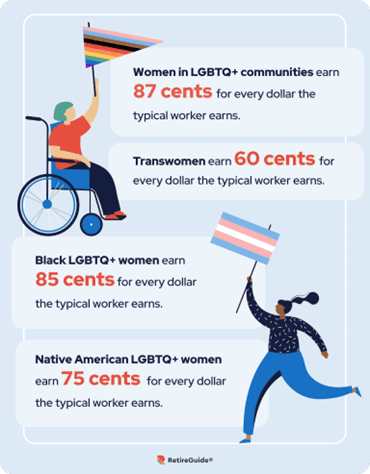

The Human Rights Campaign conducted a wage gap study with over 23,000 LGBTQ+ individuals. The study found women in the LGBTQ+ community earned less than their straight and cisgender counterparts.

Human Rights Campaign Study Findings

- Women in LGBTQ+ communities earn 87 cents for every dollar the typical worker earns.

- Transwomen earn 60 cents for every dollar the typical worker earns.

Race also plays a hand in how much women earn. The study found that black LGBTQ+ women earn 85 cents per dollar and Native American LGBTQ+ women earn 75 cents per dollar.

It’s important to continue identifying these issues and demand change. Make sure you’re being paid equally as men are in your business. Push to include an employment nondiscrimination policy that includes both “sexual orientation” and “gender identity” across all operations.

Strategies for Planning Your Retirement Finances

Now that the retirement planning roadblocks have been identified, it’s time to strategize how to overcome them. These strategies are all important pieces to the retirement planning puzzle.

Start Saving Now

It’s okay if you don’t have thousands of dollars to save up front. All that matters is you start saving as soon as you can. Even setting aside $50 is a step in the right direction.

If you are eligible, sign up for your employer’s 401(k) plan. Contribute as much as you can, or at least enough to qualify for an employer match. If you’re self-employed, you could look into a SIMPLE IRA instead.

Once you have some savings set aside, you can start looking into investment options.

Explore Your Investment and Account Options

Investing isn’t always high stress stocks with severe gains and losses. There are safe, low-risk investment and account options to consider.

Low-Risk Investment and Account Options

Investments | Account Options |

Money market account | |

Government bond | |

Money market account |

There is no one-size-fits-all investment. It’s important to identify your unique needs and how each option can accomplish them.

For example, if you want a low-risk investment that’s backed by the FDIC, you could consider a certificate of deposit (CD). If you want an investment vehicle with tax benefits and lifelong income, you could consider an annuity.

Understand Your Benefits

It’s very important to understand your Social Security benefits — including how to maximize them and knowing your claim entitlements.

“Many people don’t understand claiming entitlements to Social Security. There’s always the aspect of delaying for as long as you can to maximize your lifetime benefit,” said Lili Vasileff, CFP®, MAFF, CDFA® and President of Wealth Protection Management.

If you wait to claim at age 70, you’ll get the highest benefit amount possible. Additionally, there are other claiming opportunities if you’re divorced.

“The other part of knowing your entitlements is the claim on your ex-spouse’s record of Social Security benefits. The amount you’re entitled to claim does not affect your ex-spouse. Social Security actually pays 150% of total benefits — 100% to your ex-spouse and 50% of those benefits go to you if you’re entitled to them,” Vasileff told RetireGuide.

Building, Maintaining and Adjusting Your Budget

There are four main steps to building, maintaining and adjusting your budget.

- Set spending limits to make intentional financial decisions.

- Account for required living essentials, like your housing costs, insurance, groceries, debt payments, utilities and other monthly expenses.

- Set a specific dollar amount into your savings monthly and stick to it.

- Determine your future financial expenses. Will you need long-term medical care? Do you plan on downsizing and moving closer to family in a few years? These future expenses may seem far now, but it’s important to consider them.

It’s best to adjust your budget annually. Life always changes and your budget should mirror your new goals.

The Importance of Estate Planning

Estate planning is a set of legal documents that outline how you’d like your assets handled after you’ve passed or become incapacitated. Without one, any decisions regarding your wealth, property and health are not in your control.

For example, one document in an estate plan is the health care power of attorney. This document allows you to designate someone to make health care decisions for you if you’re unable to.

Basic Estate Planning Documents Usually Include:

- Property power of attorney

- Health care power of attorney

- Will

- Advance directive

- Trust

Source: U.S. Bank

When asked about the appropriate time to start estate planning, Solomon said, “Today. Whatever age they are, they should start estate planning and know they can always change their plan if life changes.”

“The number one thing to do today should be to find an attorney and make an appointment.”

Tips for Determining Your Retirement Lifestyle

A big part of your retirement plan is figuring out your desired retirement lifestyle.

Ask yourself the following questions to help you determine your retirement lifestyle:

- Are you accounting for just your future needs? Or are you also involving your spouse, children or grandchildren?

- Do you plan on traveling often?

- Do you need to downsize?

- Do you plan to move closer to family and loved ones?

- Does your family have a history of illness that could impact you in the future?

- Should you plan for long-term care support?

“Know what it costs to support your lifestyle. From that foundation, you’ll have to plan forward. You have to understand that you’re either going to be able to continue that lifestyle or you’re going to have to downsize,” Vasileff told RetireGuide.

“Prioritize what’s most important to you in your spending and allocate it to meet your priorities first. Such as, ‘I want to keep this house,’ or ‘I want to travel.’”

At times, there may be special circumstances to consider that could influence your retirement lifestyle.

Special Circumstances in Retirement Planning

If you have a special circumstance, like being divorced, wanting to work part time during retirement or caregiving for a loved one — there are unique retirement planning tips for you.

If you want to work part time during your retirement, it’s important to understand how it could impact your Social Security benefits. If you earn above a specific threshold, you will receive a lower Social Security benefit amount.

If you’re a caregiver for a loved one, like a disabled child for example, you could need a more complex estate plan. You may even need to consider a special needs trust, which caters specifically for disabled individuals. If you’re a caregiver, make sure to account for any additional legal and financial necessities.

Vasileff is also a nationally recognized divorce financial specialist. She offered specific tips for divorced women looking to start retirement planning.

Retirement Planning Tips for Divorced Women

- “Know your sources of income and if they will be consistent. If these are individuals who have just gone through a divorce, they need to know how long their spousal support lasts. That will help them manage their expenses.”

- “Always set aside an emergency fund that covers three months to six months of expenses. Why? Because if there’s ever a glitch or default on noncompliance with a divorce judgment, and you don’t receive your payment on time, it’s going to negatively impact everything about you. So, I always say be prepared for the anticipated.”

- “Know what retirement benefits you may be entitled to in terms of collecting from your ex-spouse, the ‘what’ the ‘when,’ and the ‘how much.’ People often forget that they may be entitled to a pension that they may have deferred compensation that’s paid out when their ex-spouse retires.”

When To Seek the Help of a Financial Advisor

Because there are so many complex parts of retirement planning, it’s likely best to seek a financial advisor as soon as possible.

A certified advisor can help you set realistic saving goals, learn about investment options, Social Security benefits, estate planning needs and help you avoid common mistakes.

“I think it’s really important that you get somebody who not only listens to you, but they also ask more than one question on the same topic,” Solomon told RetireGuide.

Common Mistakes Advisors See

Vasileff and Solomon both shared two common mistakes their clients have made. Learning about these common mistakes can help you avoid them during your retirement planning process.

Common mistakes Vasileff has seen:

Common mistakes Vasileff has seen:

“Number one is outspending your income and outliving your assets. You may fail to invest because of fear of risk, which does not help anyone.”

“And number two, you may be overly risky thinking that you need to invest more aggressively than necessary.”

Common mistakes Solomon has seen:

Common mistakes Solomon has seen:

“If they’re married, the most common mistake is assuming that everything is taken care of and not being involved. Not knowing where their money is.”

“Some will assume their children will take care of them if they have children who are doing well. There’s no guarantee that your adult child will outlive you.”

Frequently Asked Questions About Retirement Planning

How often should you review your retirement plan?

It’s in your best interest to review your retirement plan every three years and anytime there’s a major life transition.

How much income do you need in retirement?

How much income you need varies depending on your lifestyle. Breaking down your budget, savings plan and yearly expenses can help you determine how much you could need.

Can you work while in retirement?

Yes, you can still work while in retirement. Doing so may reduce your Social Security benefits if your earnings are above a certain threshold, but it is allowed.

Expert Contributors

Lili Vasileff CFP®, MAFF, CDFA® President of Wealth Protection Management

Lili Vasileff CFP®, MAFF, CDFA® President of Wealth Protection Management

Lili Vasileff is a reputable expert in the divorce and wealth protection field. With over 25 years of experience under her belt, Vasileff has served as a practitioner, author, writer, leader and speaker and has won several awards due to her efforts over the years.

Sybil Solomon President of LifeWise Strategies

Sybil Solomon President of LifeWise Strategies

Sybil Solomon specializes in the psychology of money and has presented to a diverse range of groups, including social workers, educators and NFL female professionals. Solomon has received numerous awards and recognition for her work in the field.

Lindsey CrossmierFinancial Writer

Lindsey Crossmier joined the RetireGuide team in 2022 as a writer to promote long-lasting financial literacy. She leverages her creative writing background, editorial experience and financial education from Yale to write retirement-focused financial content for those ready to prepare for their futures. Making complex information simple and accessible for all is her specialty.

- Special focus on content about life insurance, Social Security, Medicare and certificates of deposits (CDs)

- Research-based data drives her work

- Bachelor’s degree in English from the University of Central Florida

EDITED BY

Lamia ChowdhuryFinancial Editor

8 Cited Research Articles

- U.S. Bank. (2023, July 17). 4 Reasons Why Estate Planning Is Important. Retrieved from https://www.usbank.com/financialiq/plan-your-future/trusts-and-estates/why-estate-planning-is-important.html

- National Council on Aging. (2023, May 16). Women and Their Financial Security. Retrieved from https://www.ncoa.org/article/half-of-american-women-report-struggling-financially-today-leaving-them-worried-and-uncertain-about-retirement

- U.S. Department of Labor. (2023, March 14). Equal Pay Day 2023. Retrieved from https://www.dol.gov/newsroom/releases/osec/osec20230314

- Olya, G. (2023, March 3). How To Overcome These 4 Common Financial Challenges Women Face. Retrieved from https://www.nasdaq.com/articles/how-to-overcome-these-4-common-financial-challenges-women-face

- TIAA Institute. (2022, July 1). Women Are Facing A Retirement Crisis. Retrieved from https://www.tiaa.org/public/institute/publication/2022/women-are-facing-retirement-crisis-jo-ann-jenkins-ceo-aarp

- Human Rights Campaign. (2021). The Wage Gap Among LGBTQ+ Workers in the United States. Retrieved from https://www.hrc.org/resources/the-wage-gap-among-lgbtq-workers-in-the-united-states

- Fidelity Investments. (2021). 2021 Women and Investing Study. Retrieved from https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/about-fidelity/FidelityInvestmentsWomen&InvestingStudy2021.pdf

- Population Reference Bureau. (n.d.). Around the Globe, Women Outlive Men. Retrieved from https://www.prb.org/resources/around-the-globe-women-outlive-men/